Most of us dread tax season, but 110 volunteers are ready to help make it easier for us at seven of our libraries before the filing deadline. AARP Foundation Tax-Aide volunteers provide free in-person tax assistance nationwide to taxpayers over 50 years of age with low to moderate income. The IRS's Volunteer Income Tax Assistance (VITA) program also provides free in-person tax assistance for taxpayers who make less than $67,000, have a disability, or limited English-speaking skills.

You can also choose to prepare your tax return yourself, with coaching from one of our IRS-certified tax counselors, or receive access to free self-preparation tax software. Find out how to prepare your own taxes online.

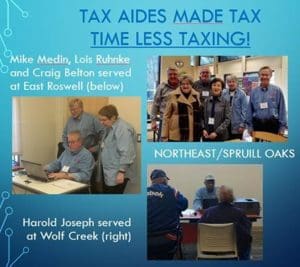

The tax aides are trained on the latest changes to the tax code and IRS-certified annually, then volunteer to prepare taxes at locations throughout the community. Training includes maintaining the confidentiality of all taxpayer information. 25 of our libraries have hosted 389 of these talented and patient volunteers who have served over 58,000 volunteer hours since 1994. Hundreds of patrons have benefitted from these services and the volunteers are happy to be back serving the community.

Basic tax resources are available on our website at https://www.fulcolibrary.org/library-services/research-assistance/federal-government-depository/new-federal-government-websites. Check our events page https://fulcolibrary.bibliocommons.com/events to sign up for any open spots at Cascade, East Roswell, Fairburn, Metropolitan, Milton, Ocee, and Northeast Spruill Oaks. More information is also available directly at the organizations’ websites: https://www.aarp.org/money/taxes/aarp_taxaide/ and https://www.irs.gov/individuals/free-tax-return-preparation-for-qualifying-taxpayers.

View the Tax-Aide calendar below

Add a comment to: Tax-Aide Volunteers Return to Libraries 2025